HAJ FUND INVESMENT IN INDONESIA 2018

HAJ FUND INVESTMENT IN INDONESIA 2018

Hajj is an annual procession involving millions of Muslims. From different corners of the world,

Muslims deliberately to be present in Mecca and Medina, to perform the fifth

pillar of Islam. Implementation of this worship, as evidence of compliance and

obedience to the commands of Allah. If realized, this ritual, in fact not only

the dimension of worship. Moreover, the pilgrimage has exceeded the limits of

existing dimensions. Nowadays, the pilgrimage has been moving the various

sectors of human life, including in its sector of the economy and business.

From an economic perspective, the Hajj rituals have moved the

circulation of money (velocity of money) in the community. Trillions of rupiah

collected through this annual procession. Precisely, more than five trillion

rupiah funds flowing hajj every year.

Indonesia is a country with a number of the largest Muslim

population in the world. In connection with the quotas Hajj Indonesia is the

largest quotas in the world. Hajj registration every year in the world is

increasing, especially in Indonesia this led to limited quota granted by the

government of Indonesia throughout the year allow the pilgrims to queue for a

few years and continues to increase until later years.

The high-interest of the Pilgrim approximately 221 thousand per

year and 500 thousand Umrah pilgrims every year, the number of candidates was

being Haji waiting until this year there are 2.8 million people in 2018.

Nevertheless Hajj Operation is identical to the issue of the

utilization of funds prospective Haj pilgrims were not transparent use. The

existence of Haji Fund Management Agency (BPKH) expected to be a surveillance

solution. The data shows the accumulation of initial deposit fund Hajj

Operation Cost (BPIH) in 2014 reached Rp. 73.79 trillion and in 2022 can reach

about Rp. 147.67 trillion.

The large number of pilgrims who have signed up compared with the

available quota, made a pilgrim in a normal atmosphere had to wait an average

of 19 years. Data in the Ministry of Haj said that the waiting period

is the shortest

in North Sulawesi

province that is

11 years old. Meanwhile, the longest waiting period is

in Aceh and East Java, which is 22 years.

When the pilgrims had paid a down payment of Rp 25 million, then

the money will settle during the waiting time, resulting in the accumulation of

funds pilgrims in large numbers. Magnitude heaping amount proportionate to the

amount hajj pilgrims were included in the waiting list (waiting list). This

gives an idea of the potential of financial management, if done with the

remains principled Sharia signs of prudence can be done without losing the

values of Islam in order to maximize value for money.

Haj Fund Management is based on six criteria: sharia principles

is all and every management of Hajj Fund based on the Islamic principle which

is kafah or comprehensive; prudential principles is the management of

Hajj Fund is done carefully, thoroughly, safely, and orderly and taking into

account the financial risk aspect; benefits is the management of Hajj

Fund should be able to provide benefits or maslahat for Jemaah Haji and Muslims;

non-profit is the management of Hajj Fund undertaken through business

management that prioritizes the use of funds development to provide the

greatest benefit to Hajj pilgrims and the benefit of Muslims, but with no

dividend for the managers; transparent is the management of Hajj Fund

should be done openly and honestly through the provision of information to the

community, especially to Hajj Pilgrims about the implementation and results of

Hajj Finance management; and accountable is the management of Hajj

Finance must be done accurately and accountable to the community, especially to

Jemaah Haji.

In article 46 of Act No. 34, 2014, on the Procedures of Fund

Management of Hajj, mentioned that;

1.

Hajj

fund shall be managed at Sharia Commercial Bank and / or Sharia Business Unit.

2.

Hajj

fund as referred to in paragraph (1) may be placed and / or invested.

3.

In

placement and / or investment as referred to in paragraph (2) shall be in

accordance with sharia principles and take into account the aspects of

security, prudence, value of benefits, and liquidity.

Continued

in article 48 of Act No. 34, 2014 that:

1.

Placement

and / or investment Hajj Fund can be done in the form of banking products,

securities, gold, direct investment and other investments.

2.

The

placement and / or investment of Hajj Fund on the date of paragraph (1) shall

be conducted in accordance with sharia principles for reasons of security, prudence,

benefits, and liquidity.

3.

Further

provisions concerning the placement and / or investment of Hajj Finance in a

Government Regulation

Based on

that act, BPKH clearly can choose if the Haj fund investment will be in place among

infrastructure, property, investment sukuk or islamic bonds, and sharia banking

products

Minister of Religious Affairs Lukman Hakim Saifuddin said that the

BPIH may be managed for productive things, including infrastructure

development. This refers to the constitution as well as fiqh rules.

"Haj funds may be used for infrastructure investments as long as compliance with sharia principles is prudent, clearly produces benefits, in accordance with legislation, and for the benefit of pilgrims and the community”

"Haj funds may be used for infrastructure investments as long as compliance with sharia principles is prudent, clearly produces benefits, in accordance with legislation, and for the benefit of pilgrims and the community”

However, many argue that the placement on infrastructure is quite

prone to leaks and does not directly impact the Hajj itself if it is returned

to the Haj financial management objectives previously mentioned. Even other

opinions are expressed But regardless of the political situation, the use of

pilgrim funds still needs to be criticized for being vulnerable to abuse for

short-term government purposes. For example, the government can create a

derivative rule of haj funds management in the form of Government Regulation

(PP) to increase the portion of Haj funds on the Sukuk instrument. This policy

triggered a very logical anxiety, considering that 2018-2019 is the maturity of

government debt of Rp 810 trillion. On the other hand, the government's budget

deficit trend continues to widen even in the 2017 APBN-P is projected to be

2.92 percent or near the 3 percent safe limit. The government is worried about

using Sukuk Haj funds to cover part of the debt maturity.

Alternative placement of other funds is to invest in the property

sector. Malaysia's Hajj Institute (LTHM) builds properties that have long-term

benefits, such as Tabung Haji Hotel in Keddah and Bay Pavilions in Sydney. Or

Indonesia can use this Haj funds by building hotels or apartments in Mecca that

can be used for the benefit of pilgrims so that the cost of pilgrimage can be

cheaper. Can also for the improvement of lodgings or hajj dormitories will also

be used for Indonesia umroh pilgrims from year to year is always increasing. Of

course this alternative will be more felt impact for the Hajj pilgrimage

itself.

Scheme or mechanism to manage. Financial hajj divided into two

initial deposit of funds Implementation Cost Hajj (BPIH) and proceeds

efficiency. BPIH deposited into the account of the Minister of Religious

Affairs through the designated beneficiary bank deposit and managed by the

Ministry of Religion by considering the value of the benefits, then most of

these funds are invested in Shariah Securities (SBSN) or sukuk country.

Furthermore, the value of benefits

(yield optimization) is used to pay various operating expenses of pilgrims in Saudi Arabia. The results of the efficiency

of the pilgrimage to the account used for the DAU

and pilgrimage services, education and propaganda, health, social and religious,

as well as infrastructure development for worship.

Hopefully those all suggest could be improve the quality of Hajj;

rationality and efficiency of BPIH usage; and benefits for the benefit of

Muslims. As we know that Haj as the fifth pillar of Islam was not only

aims to increase piety and spiritual values of the perpetrators, but also save

a great economic potential. Through Hajj economy may encourage the growth of

Islamic banking and national and also contribute to national development.

فِيهِ ءَايَٰتٌۢ بَيِّنَٰتٌۭ مَّقَامُ إِبْرَٰهِيمَ ۖ وَمَن دَخَلَهُۥ

كَانَ ءَامِنًۭا ۗ وَلِلَّهِ عَلَى ٱلنَّاسِ حِجُّ ٱلْبَيْتِ مَنِ ٱسْتَطَا عَ

إِلَيْهِ سَبِيلًۭا ۚ وَمَن كَفَرَ فَإِ نَّ ٱللَّهَ غَنِىٌّ عَنِ ٱلْعَٰلَمِينَ“In it are clear signs [such as] the standing place of Abraham. And whoever enters it shall be safe. And [due] to Allah from the people is a pilgrimage to the House - for whoever is able to find thereto a way. But whoever disbelieves - then indeed, Allah is free from need of the worlds” (Ali Imran: 97)

With the desire of the government to

establish a special institutions in managing Haj savings funds and endowments

people will increase the role of Islamic financial system, developing

alternative investment instruments for investors both domestically and abroad

who are looking for Islamic financial instruments and will encourage the growth

of the Islamic financial market in Indonesia because the funding has a

potential value Hajj great benefits if well-managed and accountable. Great

benefits can be achieved through the management of investment products and

financial services based on sharia productive and not at high risk with regard

to the principles of sharia in investing.

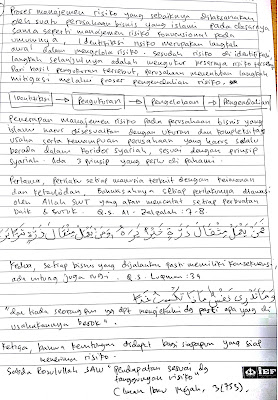

In carrying out its function as a fund

manager of a pilgrim, manager of the financial institution is required to seek

profit a lot. But many businesses make a profit which was also accompanied by a

large risk. Hence also necessary risk management in the management of the money

that has been collected from the community. Corresponding word of God in the

letter Luqman verse 34

وَمَا تَدْرِي نَفْسٌ مَاذَا تَكْسِبُ غَدًا

"...

And no one can know with certainty what -what it earned tomorrow .."

[Surah Luqman: 34] The verse explains in that Man may be planning a business

activity or investment, but human beings can not be sure what we will get from

the investment result, whether profit or loss. This is sunnatullah

Member BPKH Indonesia (Kemenag)

Bibligraphy

Al Qur'anulKarim

http://www.waspadamedan.com/index.php?option=com_content&view=article&id=7081:peran- negara-dalam-pengelolaan-dana-haji&catid=61:mimbar-jumat&Itemid=230

http://www.eramuslim.com/berita/nasional/pakar-ekonomi-syariah-sistem-pengelolaan-dana- haji-belum-efektif.htm#.VVoKk_mqqko

www.mui.org

Act No.

34, 2014

Komentar

Posting Komentar